BoE cuts rates cautiously while ECB signals continued pause

Summary

The Bank of England cut rates 25 bps to 3.75% in a narrow 5–4 vote, citing easing inflation but signalling that further cuts will be gradual. The European Central Bank held rates for a fourth meeting, confident inflation is near target, highlighting diverging UK and eurozone policy paths.

Introduction

Policy decisions at a glance

The Bank of England (BoE) delivered a widely anticipated 25 basis point rate cut, lowering Bank Rate to 3.75% following a closely split 5–4 vote and marking the fourth reduction of 2025. While easing inflation and softer economic data supported the decision, the Monetary Policy Committee emphasised that further cuts are likely to be gradual and conditional.

Governor Andrew Bailey cast the deciding vote, while cautioning that there is now more limited scope for additional easing.

The European Central Bank (ECB), by contrast, left all key interest rates unchanged at its latest policy meeting, in line with market expectations and extending its run of rate holds to four consecutive meetings. The decision reflects growing confidence that inflation is settling close to the ECB’s 2.0% medium-term target. Modest economic growth and improving domestic demand across the eurozone have reduced the immediate need for further monetary policy support.

Diverging monetary paths

Taken together, the decisions highlight a divergence in policy momentum between the UK and the eurozone, shaped by differing inflation trends, labour market conditions, and fiscal backdrops.

Bank of England recap

A split decision at the Bank of England

The narrow vote to cut rates underscores the competing forces facing the MPC. Economic growth remains weak, and inflation pressures have eased, yet core inflation risks persist, particularly in services and wage dynamics.

Inflation and labour market signals in the UK

UK inflation has slowed sharply in recent months. Headline CPI data released yesterday showed inflation falling more than expected to 3.2% year over year in November, down from 3.6% in October. The decline was driven by softer food prices and increased discounting across key retail sectors. Labour market data released earlier this week added to the case for easing, with unemployment rising to 5.1% in October, its highest level since early 2021. Many economists viewed this combination as supporting a more dovish policy stance.

Why caution still dominates the MPC outlook

However, the Committee’s language remained cautious. The four members who voted to hold rates highlighted the risk that inflation proves sticky, with labour costs expected to moderate only gradually. The Bank’s own surveys continue to show that firms plan to raise prices at a pace above the 2.0% inflation target, while wage growth is slowing only incrementally.

Governor Andrew Bailey reinforced this message, noting that while rates remain on a gradual downward path, each successive cut makes the decision more finely balanced.

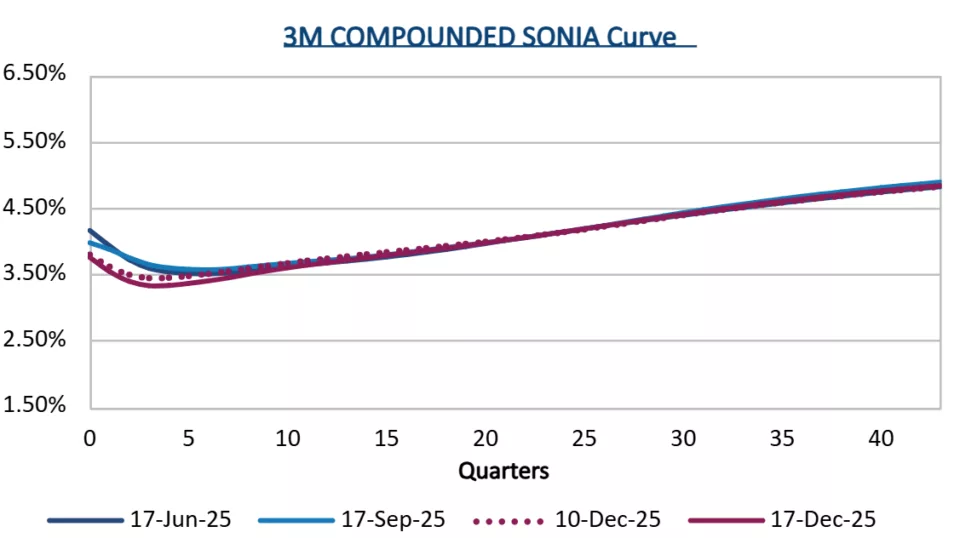

Market reaction to the BoE decision

Markets responded accordingly. Sterling rose around 0.5% against the US dollar to 1.34, while gilt yields increased by roughly five basis points, reflecting a modest scaling back of expectations for further near-term easing.

Source: Chatham Financial

European Central Bank recap

ECB maintains a steady hand

Following the decision, ECB President Christine Lagarde confirmed that the Governing Council’s vote to hold rates was unanimous and reiterated the ECB’s data-dependent, meeting-by-meeting approach to policy.

She stressed that while the ECB is in a good position, this does not imply a fixed stance. All options remain open as economic conditions evolve. Lagarde also highlighted the unusually uncertain global environment, pointing to geopolitical tensions, including Russia’s war in Ukraine, and trade developments as key risks that could materially alter the outlook.

Eurozone growth and inflation dynamics

Eurozone growth data has been more resilient than expected, prompting the ECB to revise its projections higher once again. The central bank now forecasts output growth of 1.4% in 2025, up from a previous estimate of 1.2%, following an earlier upgrade in September.

Inflation remains close to the ECB’s 2.0% target, although it rose to 2.2% in November, marking the third consecutive month above target as services prices continued to edge higher. While staff forecasts for 2025 CPI were unchanged at 2.1%, the ECB raised its projection for 2026 to 1.9% from 1.7%, reflecting firm labour markets and strengthening domestic demand that may limit further disinflation.

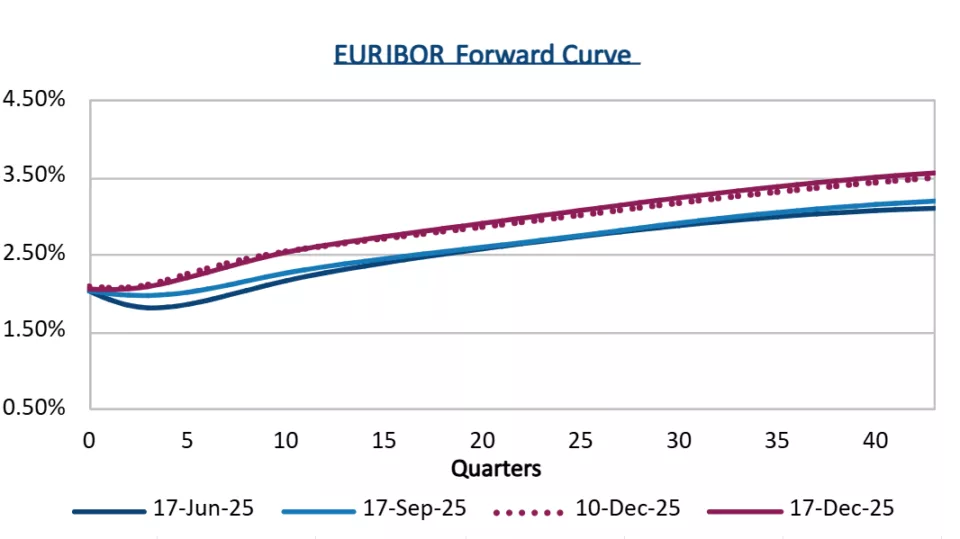

Source: Chatham Financial

Moving forward

What to watch next in the UK

Looking ahead, the Bank of England will be watching closely for signs of a rebound in UK economic activity following recent fiscal uncertainty stemming from the Autumn Budget. While headline inflation has eased, underlying price pressures remain a concern, particularly in services, suggesting the MPC will seek further confirmation that inflation is on a sustainable path lower before cutting rates again.

The labour market will be a key area of focus. Unemployment has risen from 4.3% over the past year to 5.1%, with tax measures introduced by the Labour government adding further pressure. Even so, policymakers are likely to proceed cautiously, balancing the need to support growth against the risk of easing too quickly.

What to watch next in the eurozone

The European Central Bank, by contrast, appears more comfortably positioned. Market-implied pricing points to a prolonged pause in the ECB’s easing cycle, with some expectations shifting towards potential tightening later in the decade. Recent comments from Executive Board member Isabel Schnabel, who suggested that inflation risks now outweigh the risk of an economic slowdown, underline this change in tone.

With monetary policy having supported a gradual recovery and several eurozone countries planning fiscal stimulus next year, inflation dynamics may begin to firm. The ECB’s challenge will be to maintain credibility on price stability while remaining responsive to an uncertain global backdrop.

Subscribe to receive our market insights and webinar invites

Disclaimers

Chatham Hedging Advisors, LLC (CHA) is a subsidiary of Chatham Financial Corp. and provides hedge advisory, accounting and execution services related to swap transactions in the United States. CHA is registered with the Commodity Futures Trading Commission (CFTC) as a commodity trading advisor and is a member of the National Futures Association (NFA); however, neither the CFTC nor the NFA have passed upon the merits of participating in any advisory services offered by CHA. For further information, please visit chathamfinancial.com/legal-notices.

25-0126