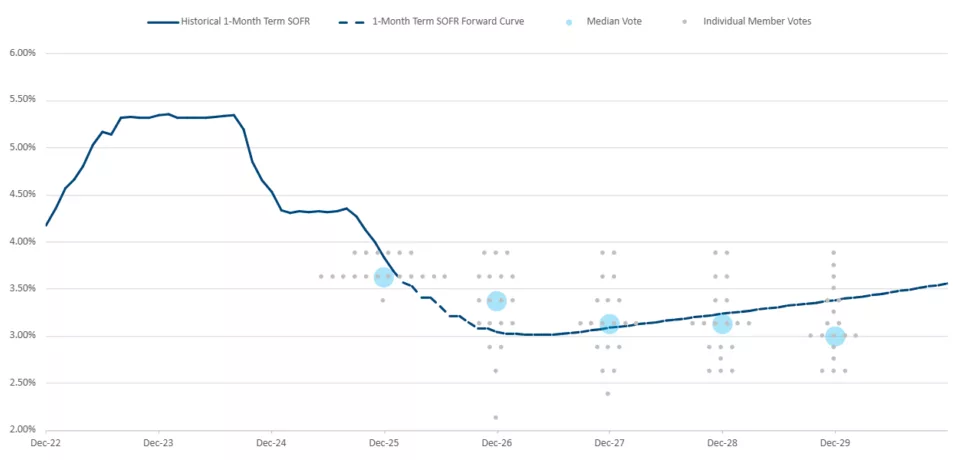

Fed dot plot vs. historical forward curves

The Federal Open Market Committee (FOMC) dot plot, commonly referred to as the Fed's dot plot, is a visual representation of the projections made by each member of the Federal Reserve regarding the Central Bank's key short-term interest rate. The dots on the plot indicate the midpoint of the fed funds rate as estimated by each of the 19 U.S. central bankers. This chart is updated quarterly and was first introduced in 2012 as part of the Fed's efforts to increase transparency. The Fed dot plot provides insight into the range of opinions held by the FOMC members, rather than just the median midpoint projection. This allows markets to gain a better understanding of the collective thinking of the Fed officials.

On the other hand, forward curves are derived from financial contracts that price and/or settle based on future settings for an underlying index. An interest rate forward curve for a market like SOFR, is at a discrete moment in time a graphical representation of the market clearing forward rates for that index. Unlike the Fed dot plot, the forward curve is live and will shift throughout the day as market forces move, especially at points farther along the curve.

Historically speaking, actual rates tend to overshoot both the forward curve and the Fed dot plot in a raising interest rate environment and rates tend to drop faster than the curve or the Fed dot plot had predicted. Although the Fed projections and the forward curve are the best estimate we can make for future rates, neither tend to be historically accurate.

FOMC median votes vs. historical forward curves

Revised December 31, 2025

Ready to have weekly rates and capital markets insights delivered to your inbox?

Subscribe for industry insights

Disclaimers

Chatham Hedging Advisors, LLC (CHA) is a subsidiary of Chatham Financial Corp. and provides hedge advisory, accounting and execution services related to swap transactions in the United States. CHA is registered with the Commodity Futures Trading Commission (CFTC) as a commodity trading advisor and is a member of the National Futures Association (NFA); however, neither the CFTC nor the NFA have passed upon the merits of participating in any advisory services offered by CHA. For further information, please visit chathamfinancial.com/legal-notices.

24-0009